Dr Eugenie Regan, Manager for UNEP-WCMC’s Integrated Biodiversity Assessment Tool and Cambridge Executive MBA 2018 participant, presents an overview of different types of conservation finance.

What is conservation finance? It seems to be a buzz word at the moment but it isn’t clear what it actually is. Don’t we all need money to undertake conservation activities? Does that mean any money that is used to fund conservation is conservation finance?

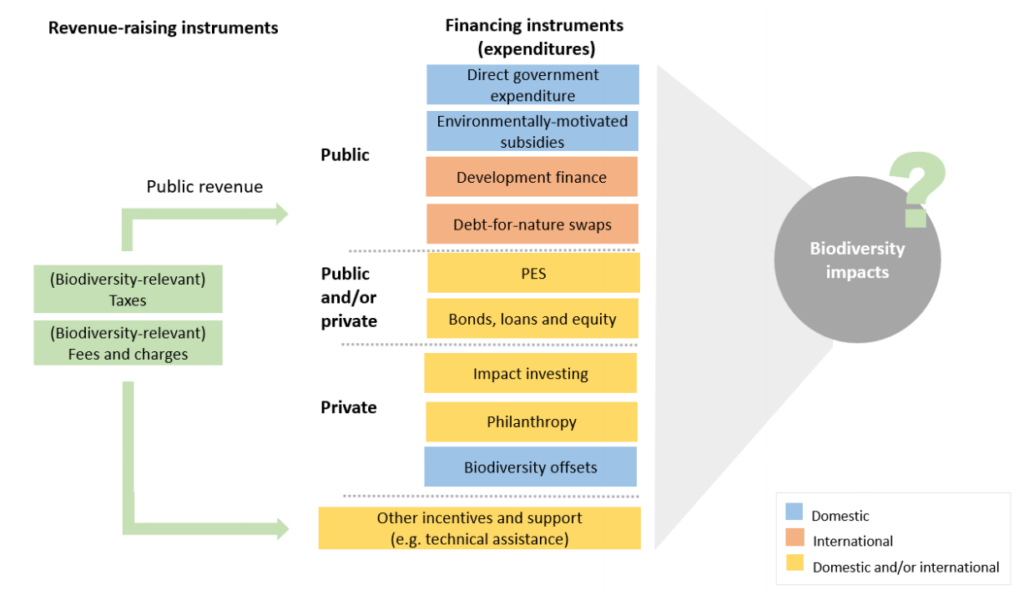

A recent report from the OECD, Biodiversity: finance and the economic and business case for action, provides a very useful conceptual framework of biodiversity finance or conservation finance (see below).

An initial conceptual framework for biodiversity finance and other types of incentives and support.

OECD (2019), Biodiversity: Finance and the Economic and Business Case for Action, report prepared for the G7 Environment Ministers’ Meeting, 5-6 May 2019.

When we talk about conservation finance we often are referring specifically to innovative financing models outside of direct government expenditure (public) or philanthropy (private). In other words, not the usual ways that conservation is financed but rather the innovative ways that conservation can be funded.

Here are some interesting examples:

Debt for nature swaps

In 2018 the Seychelles swapped US$22 million (£17 million) in sovereign debt for protecting nearly one third of its ocean area. The debt was bought at a discount by The Nature Conservancy from the UK, France, Belgium and Italy. Two new protected areas have been established as a result. One around Aldabra is 74,000 sq km (46,000 sq miles) and bans all extractive uses, from fishing to oil exploitation. The second is 134,000 square kilometers (83,000 square miles), centred on the main Seychelles island of Mahe and allows controlled activities but banning certain fishing activities. You can find an interesting article in The Guardian on this debt for nature swap here.

Payment for ecosystem services (PES)

Payments for ecosystem services (PES) are based on a relatively simple concept – to pay landowners to protect their land in the interest of ensuring the provision of some “service” rendered by nature, such as clean water, habitat for wildlife, or carbon storage in forests. Bosques Pico Bonito in Honduras is a for-profit company that generates carbon credits by planting native trees and then sells these credits through the World Bank’s BioCarbon Fund to countries aiming to offset their carbon emissions.

The company is jointly owned by investors and the communities in the area. Community members earn income and share profits from implementing the sustainable forestry practices that capture carbon. The company’s mission is to ‘be a recognised world leader in establishing and managing business models that achieve commercially attractive triple bottom line results in the areas of sustainable forestry, environmental and biodiversity restoration & protection, and social equity.’ A noble mission!

Lake Yojoa, Honduras

Bonds, loans, equity

The Seychelles are on a roll! Maybe the debt for nature swap inspired them? In any case, in October 2018 the Republic of Seychelles launched the world’s first sovereign blue bond. My corporate finance bible (literally my bed-time reading during the MBA corporate finance course – much to the amusement of my husband!) defines a bond as ‘an instrument that most governments and major corporations use to borrow money’ or an IOU (literally “I owe you”). They raised US$15 million (£11 million) from international investors, the proceeds of which will include support for the expansion of marine protected areas, improved governance of priority fisheries and the development of the Seychelles’ blue economy. Interestingly, this blue bond is partially guaranteed by a US$5 million (£4 million) guarantee from the World Bank (IBRD) and further supported by a US$5 million (£4 million) concessional loan from the GEF which will partially cover interest payments for the bond. Therefore, lowering the risk for investors and making the bond a more attractive investment.

The Althelia Biodiversity Fund Brazil (ABF Brazil) is an investment fund dedicated to making pioneering impact investments in the Legal Amazon. Through the fund, Mirova Natural Capital Limited aims to deploy US$100 million (£76 million) of blended finance into sustainable activities that protect, restore or otherwise improve biodiversity and community livelihoods. ABF Brazil invests in “sustainable businesses, cooperatives, NGOs and other entities that have a positive impact on biodiversity and communities in the Amazon, building resilience in forest ecosystems & communities, and harnessing the Amazon forest’s natural capital to generate real assets and create sustainable economic growth and livelihoods”. Returns are generated from loan repayments, profit sharing arrangements, sale of equity, dividends, carbon or a combination of one or more of these instruments. So this is fund represents both loans and equity in the diagram above (as well as PES if returns come from selling carbon credits, for example). It is focused on private finance.

Impact investing

Washington, D.C. had a problem. Like many cities with antiquated sewer systems, it was under orders from the Environmental Protection Agency to reduce storm water runoff that threatened the region’s water quality. Their original plan was a US$2.6 billion (£2 billion) tunnel system to keep overflow out of local rivers. Partway through the project, however, they realised that green infrastructure initiatives would cost much, much less – US$25 million (£19 million). In order to finance this work, they launched Washington D.C.’s US$25 million (£19 million) Environmental Impact Bond in 2016. It is an example of a Social Impact Bond where investors put up the money that is used to address the problem and, if the agreed targets are met, the investors are paid back with interest. Unlike normal bonds (see above), the financial return of the investment is tied directly to the success of the project. Investors investing in these types of initiatives are known as ‘impact investors’. Read more about this bond here.

Another example of impact investing is the new Rhino Impact Bond coordinated by the Zoological Society of London and Conservation Capital. This five-year US$50 million (£38 million) ‘bond’ is the world’s first financial instrument for species conservation. Another example of a Social Impact Bond, the investors will be paid back their capital and a coupon if African black rhino populations in five sites in Kenya and South Africa increase over five years. The donors (including the Global Environment Facility) commit to paying back investors when specific outcomes are achieved by the rhino protection service providers. So the money ultimately comes from philanthropy but the coordinators are hoping that finance to pay back the investors will also come from other sources such as tourism.

Leave a Reply